Finding almost eighty bucks can feel like striking gold, a true cash blessing. It might not be the life-changing sum of millions, but for some folks, it could mean the difference between having to skip that essential need or being able to treat yourself.

What would you do with seventy-nine dollars? Would it be enough to finally treat yourself? Or perhaps you'd put it toward a rainy day fund? Whatever your plan, finding this much cash can definitely bring a smile to your face.

Dissecting $79: Where Does It Go?

Ever wonder what your hard-earned funds go when you spend them on that tasty new gadget? With a price tag of sixty-five dollars, it can seem like an arm and a leg. But let's analyze that cost to see clearly where your money {ends up|goes|.

- Design| This expense covers the brains behind that item.

- Marketing and advertising| Getting the word out is an investment!

- Distribution costs| From shelves to staff, managing logistics demands capital.

Start on the $79 Challenge: Make it Last a Month!

Living on a tight budget for a month can seem like an impossible task. But with some careful planning and creativity, you can absolutely make it happen! The $79 challenge is all about living frugally for 30 days using only $79. That's right, just shy of 80 to cover all your essential needs - food, housing, transportation, and everything else. It's a real test of resourcefulness and can help you discover new ways to save money in the long run.

Before you dive in, there are a few things you need to know about making this challenge work for you. First, be realistic about your needs and set some firm boundaries. Decide what's absolutely essential and where you can compromise. Second, get creative! Think outside the box when it comes to grub and fun.

Third, stay motivated by tracking your progress and celebrating your successes along the way. The $79 challenge isn't just about saving money; it's also an opportunity to build valuable life skills and develop a deeper appreciation for what truly matters.

Are you up for the task? Give it your best shot!

Boost Your Bucks: Smart Spending Strategies

Cracking the code to allocate your cash wisely can feel like navigating a labyrinth. But fear not! With these golden tips, you can reshape your financial outlook. Start by creating a budget that mirrors your goals. Then, explore ways to reduce expenses on discretionary expenditures. Consider viable options for fun, like exploring check here free activities in your area. Remember, every dollar counts!

- Adopt the power of comparison shopping

- Automate your savings to cultivate a healthy financial structure.

- Consider unexpected income as an chance to pay down financial burdens

The Power of $79: Investing and Savings

It may seem like a small amount, but the potential $79 can launch a journey toward financial prosperity. Whether you're a novice investor, $79 can be your stepping stone for building wealth. Consider putting it towards a high-yield savings account. While time is your greatest asset, even a small amount invested consistently can compound and grow.

- Start small, think big: Investing just $79 can set you on the path to financial success.

- Micro-investing: Apps allow you to invest spare change or as little as $79 in a diversified portfolio.

- The power of compounding: Over time, even small amounts invested regularly can grow significantly thanks to the magic of compounding.

Can You Get Anything for $79?

Seventy-nine dollars might not seem like a lot, but you'd be surprised at what you can snag for that price. A good pair of headphones, maybe even a trendy purse could be yours. You could grab a new book. For the techie, there are always gadgets available within this budget. Or, get practical with kitchenware. The possibilities are truly vast.

- Check out a sale at your favorite shop. You might just find that perfect item

- Don't be afraid to something you've been wanting.

- Compare prices to get the best deal.

Neve Campbell Then & Now!

Neve Campbell Then & Now! Rick Moranis Then & Now!

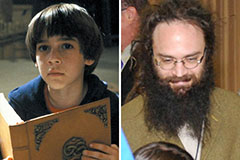

Rick Moranis Then & Now! Barret Oliver Then & Now!

Barret Oliver Then & Now! Soleil Moon Frye Then & Now!

Soleil Moon Frye Then & Now! Tina Louise Then & Now!

Tina Louise Then & Now!